FOREX affects Fancy Color Diamond Prices & Valuation

During my research for an article about Fancy Vivid Pink Diamonds vs. Fancy Vivid Blue Diamonds in honor of the upcoming auction in Geneva, I came across the 10.31 carat Fancy Vivid Pink diamond sold back on November 17, 2005 at Sotheby’s Geneva. At the time, it sold for USD$3,898,602. What caught my attention in regards to this diamond was that its estimated value in CHF at the time of the sale was valued at between CHF4,000,000 to CHF5,000,000 and ended up selling for CHF5,172,000. The exchange rate with the USD was 1.33. It triggered me to also think back about an earlier article I wrote about the major global banks being fined for FOREX manipulation back in 2014. I decided to revisit this complicated but very interesting matter.

Dream On!

Before I analyze this, I wanted to make sure we all understand one thing about the past 10 years- the 10.31ct Fancy Vivid Pink diamond was sold for $3,898,602, or $378,137.92 per carat to be exact. Please take a second and dream about this number because any dealer you speak to nowadays would certainly tell you to dream on if you wanted to buy that diamond at that price. Now let’s go forward 10 years. The last Fancy Vivid Pink diamonds that were sold that were remotely close in size, were the 8.41 carat Fancy Vivid Purplish Pink diamond that sold on November 7, 2014 for $17.78 million ($2.114 million per carat), representing a 459% growth in value, and that is for a diamond under 10 carats. Most recently a very prominent dealer lost a great deal of money because a consumer saw his diamond somewhere on the internet listed by a previous owner from three years earlier with the price of that time. Unfortunately, the consumer backed away from the current deal because he already had the misconception of the value of the diamond, which he did not know had increased dramatically due to market trends of very high demand for rare, unique, and one of kind Jewels.

The 10.31ct Fancy Vivid Pink diamond Image credit: Sotheby’s

The 10.31ct Fancy Vivid Pink diamond Image credit: Sotheby’s

The 8.41 carat Fancy Vivid Purplish Pink diamond Image credit: Sotheby’s

The 8.41 carat Fancy Vivid Purplish Pink diamond Image credit: Sotheby’s

Inflation vs. FOREX

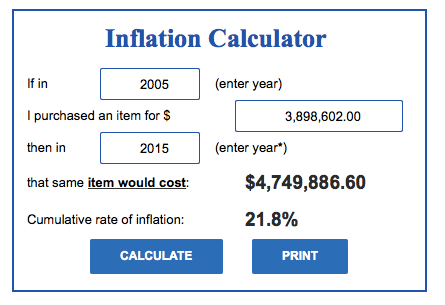

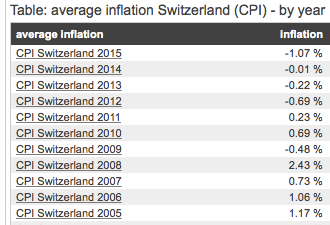

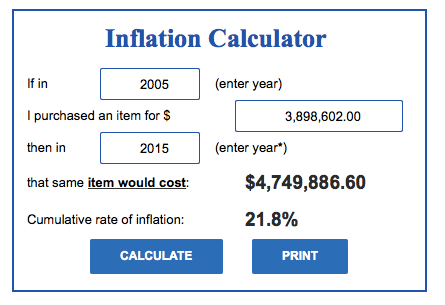

It would only be fair in this analysis if we would examine how inflation, and not only FOREX, has changed in the past 10 years for both the USA and Switzerland. We used the USA in this example simply because the item was priced in CHF and USD. From 2005 to 2015, the total inflation in the USA was 21.8% while in Switzerland it was a mere 3.84% according the statistical information. According to the official inflation calculator, if one had paid $3,898,602 for something in 2005, in 2015 that same thing would cost $4,749,886.60.

Inflation in the USA totaled 21.8% from 2005 to 2015 Source: usinflationcalculator.com

Inflation in the USA totaled 21.8% from 2005 to 2015 Source: usinflationcalculator.com

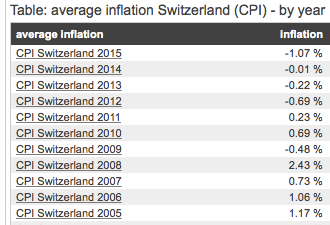

Inflation in Switzerland totaled 3.84% from 2005 to 2015 Source: inflation.eu

Inflation in Switzerland totaled 3.84% from 2005 to 2015 Source: inflation.eu

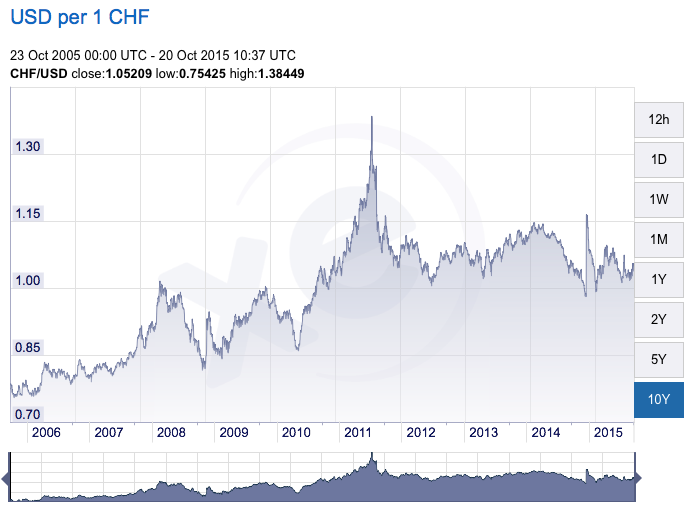

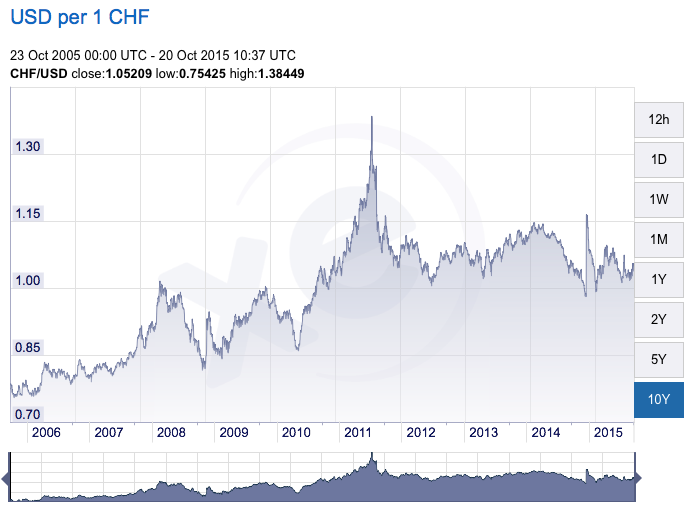

The exchange rate (FOREX) between the USD and the CHF shows a somewhat similar picture to inflation on the basis that the CHF has increased in value over the 10 years. Back in 2005 a USD$1 was able to get CHF 1.33, while today that same USD$1 would get only CHF 0.95.

CHF vs USD from 2005-2015 Source: xe.com

CHF vs USD from 2005-2015 Source: xe.com

In both analyses, that diamond would earn more money in 2015 than it did in 2005, whether you are looking at it as a FOREX trade or simply at its value due to inflation.

Conclusion

Let’s assume you bought the diamond and are now figuring out how much its worth. If you would have paid $3,768,950 in USD in 2005, you would have exchanged it to CHF 5,172,000 in order to pay for it locally in Switzerland. Assuming that you would have put it up for sale right now (not taking into account growth in value or anything else), you would have sold it in the upcoming Geneva auction for the same amount of CHF – and then earned money off of it because the value of the dollar went up. You would have earned USD $5,430,600 on the $3,768,950 diamond due to the exchange rate, an increase in value of 44% (and this is without taking inflation into account!)

Now that is quite a nice amount of money that you earned on your pink diamond!

Related Posts

- Sotheby’s Will Try To Reignite The Love For Fancy Color Diamonds With A Unique Pair Of Hearts At The Upcoming Hong Kong Auction

- Do Jewelry Appraisers Know How To Evaluate Fancy Color Diamonds?

- Don’t Be Stupid And Invest In Fancy Color Diamonds!

- Coronavirus Covid-19 Proves Emotional Stock Trading More Turbulent Than Ever, But Fancy Color Diamonds Are More Stable

- Wealth Concentration Index Continues Trend Despite Market Conditions

FOREX affects Fancy Color Diamond Prices & Valuation

During my research for an article about Fancy Vivid Pink Diamonds vs. Fancy Vivid Blue Diamonds in honor of the upcoming auction in Geneva, I came across the 10.31 carat Fancy Vivid Pink diamond sold back on November 17, 2005 at Sotheby’s Geneva. At the time, it sold for USD$3,898,602. What caught my attention in regards to this diamond was that its estimated value in CHF at the time of the sale was valued at between CHF4,000,000 to CHF5,000,000 and ended up selling for CHF5,172,000. The exchange rate with the USD was 1.33. It triggered me to also think back about an earlier article I wrote about the major global banks being fined for FOREX manipulation back in 2014. I decided to revisit this complicated but very interesting matter.

Dream On!

Before I analyze this, I wanted to make sure we all understand one thing about the past 10 years- the 10.31ct Fancy Vivid Pink diamond was sold for $3,898,602, or $378,137.92 per carat to be exact. Please take a second and dream about this number because any dealer you speak to nowadays would certainly tell you to dream on if you wanted to buy that diamond at that price. Now let’s go forward 10 years. The last Fancy Vivid Pink diamonds that were sold that were remotely close in size, were the 8.41 carat Fancy Vivid Purplish Pink diamond that sold on November 7, 2014 for $17.78 million ($2.114 million per carat), representing a 459% growth in value, and that is for a diamond under 10 carats. Most recently a very prominent dealer lost a great deal of money because a consumer saw his diamond somewhere on the internet listed by a previous owner from three years earlier with the price of that time. Unfortunately, the consumer backed away from the current deal because he already had the misconception of the value of the diamond, which he did not know had increased dramatically due to market trends of very high demand for rare, unique, and one of kind Jewels.

The 10.31ct Fancy Vivid Pink diamond Image credit: Sotheby’s

The 10.31ct Fancy Vivid Pink diamond Image credit: Sotheby’s

The 8.41 carat Fancy Vivid Purplish Pink diamond Image credit: Sotheby’s

The 8.41 carat Fancy Vivid Purplish Pink diamond Image credit: Sotheby’s

Inflation vs. FOREX

It would only be fair in this analysis if we would examine how inflation, and not only FOREX, has changed in the past 10 years for both the USA and Switzerland. We used the USA in this example simply because the item was priced in CHF and USD. From 2005 to 2015, the total inflation in the USA was 21.8% while in Switzerland it was a mere 3.84% according the statistical information. According to the official inflation calculator, if one had paid $3,898,602 for something in 2005, in 2015 that same thing would cost $4,749,886.60.

Inflation in the USA totaled 21.8% from 2005 to 2015 Source: usinflationcalculator.com

Inflation in the USA totaled 21.8% from 2005 to 2015 Source: usinflationcalculator.com

Inflation in Switzerland totaled 3.84% from 2005 to 2015 Source: inflation.eu

Inflation in Switzerland totaled 3.84% from 2005 to 2015 Source: inflation.eu

The exchange rate (FOREX) between the USD and the CHF shows a somewhat similar picture to inflation on the basis that the CHF has increased in value over the 10 years. Back in 2005 a USD$1 was able to get CHF 1.33, while today that same USD$1 would get only CHF 0.95.

CHF vs USD from 2005-2015 Source: xe.com

CHF vs USD from 2005-2015 Source: xe.com

In both analyses, that diamond would earn more money in 2015 than it did in 2005, whether you are looking at it as a FOREX trade or simply at its value due to inflation.

Conclusion

Let’s assume you bought the diamond and are now figuring out how much its worth. If you would have paid $3,768,950 in USD in 2005, you would have exchanged it to CHF 5,172,000 in order to pay for it locally in Switzerland. Assuming that you would have put it up for sale right now (not taking into account growth in value or anything else), you would have sold it in the upcoming Geneva auction for the same amount of CHF – and then earned money off of it because the value of the dollar went up. You would have earned USD $5,430,600 on the $3,768,950 diamond due to the exchange rate, an increase in value of 44% (and this is without taking inflation into account!)

Now that is quite a nice amount of money that you earned on your pink diamond!

Related Posts

- Do Collectible Cars Withstand Wealth Concentration Conditions and Requirements?

- Fancy Color Diamond Manufacturer Eden Rachminov Sheds Light on Price Structure

- How To Build and Protect Wealth from Negative Interest Rate Policy (NIRP)

- Why Diamond Sales May Drop in Asia?

- Do Diamonds Increase in Value? Ask The Professionals.

Leave a Reply

You must be logged in to post a comment.