How to Invest in Diamonds

Life is about choices. Whether business related or non-business related, in most situations in life we are generally presented with three scenarios from which to choose, and of which we most likely select the route with which we are most comfortable. Investing in diamonds is no exception to this rule. There are three main ways of investing in diamonds: acquiring the physical diamond directly, investing in financial instruments backed by the physical diamonds, such as diamond funds, and investing in diamond mining companies. If you are reading this article, chances are that the thought of investing in diamonds has crossed your mind before, and this interests you enough to discover further about it. Let’s review each method with its own benefits and challenges (in no particular order). Got any questions about any of these channels when you are done reading about them? Contact us and we will be happy to address any questions that you may have!

A loose diamond laid out for observation together with a diamond tweezer

Investing in Diamond Mining Companies

For the purpose of analyzing diamond producing companies, I will focus on the seven major mining companies that recently joined forces and created the Diamond Producers Association (DPA). It goes without saying that many other diamond mining companies exist, although you would probably not choose to invest in one of them as they are not one of the main seven.

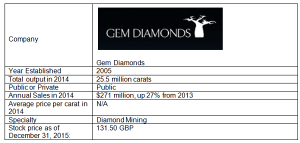

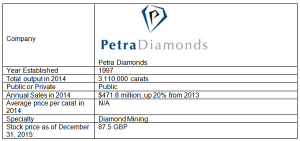

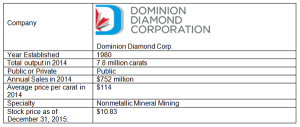

Back in March 2015, mining giant Rio Tinto and the six other major mining companies (Alrosa, De Beers, Dominion Diamonds, Lucara Diamonds, Petra Diamonds and Gem diamonds), who collectively represent over 90% of global diamond supply, met in privacy in London to discuss and review the state of the diamond industry because after a few months of prolonged supply decline. In order to repair the damage, the decision was made to create the ‘Diamond Producers Association’, a body to represent the diamond mining companies, who would put efforts together to promote diamonds as a generic product to the public in order to increase demand. By doing so, the mining companies hope to help the industry as a whole. In order to accomplish this, each has deposited seed money and together have created a $6 million fund to help educate consumers again about the benefits and the magic of diamonds. By the end of May 2015, the association was a legal entity based in London. All companies had publicized a unified press release describing their vision and ultimate goal.

The DPA explained that its mandate will include:

• Maintaining and enhancing consumer demand for and confidence in diamonds, including joint-category marketing initiatives

• Providing a reliable source of industry information, including trade and consumer research

• Acting as the unified voice of the diamond producers, when required and/or appropriate, with industry and non-industry forums/organizations

• Communicating the role and contribution of diamond producers to the diamond sector and broader society

• Sharing best practices in health and safety, license to operate, supply chain integrity and environmental management.

The Members of the Diamond Producers Association

As an investor, it is a personal choice whether you prefer to choose this method of diamond investment or any of the other two options. However, this channel is most similar to investing in any profitable company, except that the field is narrowed down to companies that produce diamonds. That being said, if that the is type of investment that you would be most comfortable with, as it may be the most familiar to you, this would be a great way for you to invest in diamonds. This is the farthest removed investment from the diamonds that is possible while still being a diamond investment. Out of these 7 companies, Alrosa produces by far the largest carat weight of diamonds annually, and Rio Tinto is the leader in both brand recognition and sales. However, in order for you to choose properly in which companies to invest, a proper financial analysis is recommended.

Investing in Diamond Backed Financial Instruments (Diamond Funds)

Unfortunately, most diamond funds are closed to the broader public, so the information below is as best as we can provide.

Many attempts have been tried to start a diamond fund by various entities over the years, and most have failed. Why? Not because diamonds are not a good investment, and not because the fund manager has not had investment experience under his belt.

The most common reason why diamonds funds fail is because the fund manager does not know how the asset (diamonds) are purchased, sold, traded.

Most of the attempts to open and run a diamond fund have been made by the financial industry. Only the combined efforts of diamond experts who trade in diamonds for a living and of financial experts can properly manage a diamond fund, since diamond experts know how these assets behave, how to sell them and how to buy them in order to maximize the returns for investors. For example, an energy specialist who may not be a CFA can manage an energy fund, but the best CFA in the world will never be able to maximize returns on an energy fund, since that CFA most likely has general knowledge in fund management but does not know what energy should be purchased for, sold for, and where we can extract the most value for investors. Diamonds are a similar case. The fund would need an expert trader in order to succeed. This is especially the case for fancy color diamonds, as they make up only 0.01% of annual global diamond supply, and of that 0.01%, only a minute amount are investment grade fancy color diamonds, mostly pink, blue, red and yellow diamonds.

Diamond Funds to Consider

I have found a handful of diamond funds that claim they have a diamond fund. Novel Asset Management is one of the funds, other funds are run by devanx.ch, Scarabaeus in Europe, Finanz Konzept AG and Pink Iguana PLC. Diamond Asset Advisors AG out of Zurich also claims a piece of this industry.

The most transparent of all, in my opinion is Finanz Konzept AG. It is the only one offering regular updates on the fund, and its performance. It may or may not be a top performer, but at least it is the most transparent.

Pink Iguana PLC was established with the help of the Asscher family, who have been involved within the diamond industry for over 150 years. No information is available online about Pink Iguana except for a landing page. In my opinion, a minimum of information must be open to the public in order to be trustworthy.

Devanx claims it has been able to track sales of red diamonds for the last 50 years. It also helps investors get their hands on these assets. The company also presents to potential investors 5 key exit strategies.

Image courtesy of Devanx

Scarabaeus Wealth Management of Liechtenstein offers various investment funds to its clients. Newly created fund invests in diamonds. It has a special arrangement with La Serla for the acquisition and disposition of diamonds.

Novel Asset Management is headed by Alan Landau as its CEO, a veteran in the investment community, and Chief Investment Officer Eliad Cohen, who has been in the diamond industry for over a decade. This company is backed by Novel Collection, a 20+ year company within the diamond industry trading in Fancy Color Diamonds.

Diamond Asset Advisors AG out of Zurich also claims a chunk of this business, most recently striking a deal with the De Beers network of stores. From my understanding, they are involved in financing purchases made from the De Beers stores. It is headed by Dr. Peter Laib, a veteran in the private equity investment world.

Diamond Capital Fund is yet another entity claiming to be involved in the diamond investment fund world. Visit their website and be the judge if this is something you would ever want to be involved with.

Another company to claim a piece of this investment field is Trevita, based out of Cyprus. Visit their website and let me know what you think in the comments below…

A recent addition to this list of investment funds would be Valhalla Diamond Fund out of Canada, a recently launched a fund geared towards retail investors.

Sciens Capital Management also claims a piece of this field. How? Not sure, but you can visit their website and read all about it. Who is running it?

I think that by now, you have a good idea about all those that claim to have a diamond investment fund. And for the best of them all, visit: www.naturaldiamondinvestments.com and decide what to do. Humor me and let me know your reaction in the comments or in an email!

If you are really interested in investing in a diamond based financial product, let us know, and we will direct you in the right way to a secure fund.

Buying an Investment Diamond

The last way to invest in diamonds is investing directly in the physical diamonds. Buying individual diamonds is one of the safest ways of diversifying into this industry.

For centuries, people have turned to diamonds as a method of wealth condensation and wealth transportation. However, in the last few decades, as the popularity of certain diamonds has significantly increased and education about their investment benefits better known, the concept of diamonds as an investment has arisen in a big way. The most notable has been the big-ticket fancy color diamonds that are sold by auction houses such as Sotheby’s and Christie’s. These diamonds time and again earn incredible prices per carat at auction, shattering previously set records and continually gaining in value and helping increase overall value for stones of those colors in the market as a whole. While by no means are all diamonds sold in this manner, it most definitely has an effect on the mood and approach that the world markets take toward these stones.

However, it is important to remember a few important points about this method of diamond investment. First and foremost, the most important is that not all diamonds are investment grade diamonds. Only a diamond investment specialist is qualified to tell you whether a diamond is investment worthy. The measure of a properly informed diamond investment specialist is whether he can explain why the diamond at hand is investment worthy. As diamonds actually occur naturally in all colors of the rainbow, and also appear in a completely colorless variety with which most of the world is familiar, it is important for investors to know that not all colors are equally valued and equally in demand by the market, and some diamonds are not an investment at all. This goes beyond an understanding of the 4 C’s an actually extends to knowledge about the price trends of the most demanded colors and carat sizes, and to what extent their values have appreciated. In general, a diamond investment expert will recommend investing in fancy vivid pink and fancy vivid blue diamonds in as large a size as your budget can allow, although this is not a steadfast rule. Another measure of a proper diamond investment expert is whether they actually have access to investment worthy diamonds. Traditionally, these diamonds have been bought and traded by a select few, and not just any diamond dealer has access to diamonds of the highest caliber. Many will claim to be able to provide you with an investment diamond, but few can deliver on that promise.

Second, this kind of investment is only a long term investment, and the recommended strategy is a buy and hold strategy for a period of at least 20 years. This means that only people who are able to set aside this significant sum of money that is required for this investment, and won’t need that money at hand in the near future, would be able to invest. While it is possible to earn a good return on an investment grade diamond in 5 years or less, the likelihood that an investment grade diamond’s value will rise increases significantly over a longer period of time.

Third, one of the great benefits of privately owning an investment diamond is the control of the diamond in its entirety. That means that you alone will control when it will be resold, if at all, which allows you the freedom of passing it on as a heritage, and the security that as a universal asset worldwide, it will always be redeemable for its true value regardless of where it is ultimately resold. This fact is very appealing and a big draw for private diamond investments.

The Blue Moon diamond, the biggest headline making diamond of the past year

Several questions arise:

Where do I buy?

What do I buy?

When should I buy?

How do I dispose of the diamond in the future?

We have written many articles about this subject. Feel free to contact to further discuss your specific details!

Regardless of the diamond investment method that you choose, be very informed about the pros and cons of that decision. One of the safest ways to invest in diamonds, which also gives you the most control, is to buy an investment diamond privately and directly. That is why this method is so popular amongst the people who choose to invest in diamonds. That being said, there is no one-size-fits-all solution and qualities that may be a priority for you would not be the same priorities for another investor. However, diamond investments are without a doubt the most lucrative addition to a properly diversified investment portfolio that exists in the world today. We have written extensively about the incredible returns that fancy color investment grade diamonds earn over a long term investment period, especially in comparison to some of the safest and best earning investments that exist. That is how we can decisively recommend fancy color diamonds as an investment and are happy to answer any questions that you may have about the different investment channels!

Ask away in the comments, or contact us via email for more information!

Related Posts

- Fancy Color Diamonds Investment Guide – Part 1

- Is Diamond Investing Well Worth The Risks Involved?

- Argyle Tender Is A Financial Vaccine, Becoming The Bitcoin Of Pink Diamonds As Covid-19 Continues On Its Global Rampage

- Petra Diamonds Sells Five Blue Rough Diamonds For A Cheap Price, Right!

- Petra Diamonds Unveils Five High Quality Blue Diamonds From The Cullinan Mine

How to Invest in Diamonds

Life is about choices. Whether business related or non-business related, in most situations in life we are generally presented with three scenarios from which to choose, and of which we most likely select the route with which we are most comfortable. Investing in diamonds is no exception to this rule. There are three main ways of investing in diamonds: acquiring the physical diamond directly, investing in financial instruments backed by the physical diamonds, such as diamond funds, and investing in diamond mining companies. If you are reading this article, chances are that the thought of investing in diamonds has crossed your mind before, and this interests you enough to discover further about it. Let’s review each method with its own benefits and challenges (in no particular order). Got any questions about any of these channels when you are done reading about them? Contact us and we will be happy to address any questions that you may have!

A loose diamond laid out for observation together with a diamond tweezer

Investing in Diamond Mining Companies

For the purpose of analyzing diamond producing companies, I will focus on the seven major mining companies that recently joined forces and created the Diamond Producers Association (DPA). It goes without saying that many other diamond mining companies exist, although you would probably not choose to invest in one of them as they are not one of the main seven.

Back in March 2015, mining giant Rio Tinto and the six other major mining companies (Alrosa, De Beers, Dominion Diamonds, Lucara Diamonds, Petra Diamonds and Gem diamonds), who collectively represent over 90% of global diamond supply, met in privacy in London to discuss and review the state of the diamond industry because after a few months of prolonged supply decline. In order to repair the damage, the decision was made to create the ‘Diamond Producers Association’, a body to represent the diamond mining companies, who would put efforts together to promote diamonds as a generic product to the public in order to increase demand. By doing so, the mining companies hope to help the industry as a whole. In order to accomplish this, each has deposited seed money and together have created a $6 million fund to help educate consumers again about the benefits and the magic of diamonds. By the end of May 2015, the association was a legal entity based in London. All companies had publicized a unified press release describing their vision and ultimate goal.

The DPA explained that its mandate will include:

• Maintaining and enhancing consumer demand for and confidence in diamonds, including joint-category marketing initiatives

• Providing a reliable source of industry information, including trade and consumer research

• Acting as the unified voice of the diamond producers, when required and/or appropriate, with industry and non-industry forums/organizations

• Communicating the role and contribution of diamond producers to the diamond sector and broader society

• Sharing best practices in health and safety, license to operate, supply chain integrity and environmental management.

The Members of the Diamond Producers Association

As an investor, it is a personal choice whether you prefer to choose this method of diamond investment or any of the other two options. However, this channel is most similar to investing in any profitable company, except that the field is narrowed down to companies that produce diamonds. That being said, if that the is type of investment that you would be most comfortable with, as it may be the most familiar to you, this would be a great way for you to invest in diamonds. This is the farthest removed investment from the diamonds that is possible while still being a diamond investment. Out of these 7 companies, Alrosa produces by far the largest carat weight of diamonds annually, and Rio Tinto is the leader in both brand recognition and sales. However, in order for you to choose properly in which companies to invest, a proper financial analysis is recommended.

Investing in Diamond Backed Financial Instruments (Diamond Funds)

Unfortunately, most diamond funds are closed to the broader public, so the information below is as best as we can provide.

Many attempts have been tried to start a diamond fund by various entities over the years, and most have failed. Why? Not because diamonds are not a good investment, and not because the fund manager has not had investment experience under his belt.

The most common reason why diamonds funds fail is because the fund manager does not know how the asset (diamonds) are purchased, sold, traded.

Most of the attempts to open and run a diamond fund have been made by the financial industry. Only the combined efforts of diamond experts who trade in diamonds for a living and of financial experts can properly manage a diamond fund, since diamond experts know how these assets behave, how to sell them and how to buy them in order to maximize the returns for investors. For example, an energy specialist who may not be a CFA can manage an energy fund, but the best CFA in the world will never be able to maximize returns on an energy fund, since that CFA most likely has general knowledge in fund management but does not know what energy should be purchased for, sold for, and where we can extract the most value for investors. Diamonds are a similar case. The fund would need an expert trader in order to succeed. This is especially the case for fancy color diamonds, as they make up only 0.01% of annual global diamond supply, and of that 0.01%, only a minute amount are investment grade fancy color diamonds, mostly pink, blue, red and yellow diamonds.

Diamond Funds to Consider

I have found a handful of diamond funds that claim they have a diamond fund. Novel Asset Management is one of the funds, other funds are run by devanx.ch, Scarabaeus in Europe, Finanz Konzept AG and Pink Iguana PLC. Diamond Asset Advisors AG out of Zurich also claims a piece of this industry.

The most transparent of all, in my opinion is Finanz Konzept AG. It is the only one offering regular updates on the fund, and its performance. It may or may not be a top performer, but at least it is the most transparent.

Pink Iguana PLC was established with the help of the Asscher family, who have been involved within the diamond industry for over 150 years. No information is available online about Pink Iguana except for a landing page. In my opinion, a minimum of information must be open to the public in order to be trustworthy.

Devanx claims it has been able to track sales of red diamonds for the last 50 years. It also helps investors get their hands on these assets. The company also presents to potential investors 5 key exit strategies.

Image courtesy of Devanx

Scarabaeus Wealth Management of Liechtenstein offers various investment funds to its clients. Newly created fund invests in diamonds. It has a special arrangement with La Serla for the acquisition and disposition of diamonds.

Novel Asset Management is headed by Alan Landau as its CEO, a veteran in the investment community, and Chief Investment Officer Eliad Cohen, who has been in the diamond industry for over a decade. This company is backed by Novel Collection, a 20+ year company within the diamond industry trading in Fancy Color Diamonds.

Diamond Asset Advisors AG out of Zurich also claims a chunk of this business, most recently striking a deal with the De Beers network of stores. From my understanding, they are involved in financing purchases made from the De Beers stores. It is headed by Dr. Peter Laib, a veteran in the private equity investment world.

Diamond Capital Fund is yet another entity claiming to be involved in the diamond investment fund world. Visit their website and be the judge if this is something you would ever want to be involved with.

Another company to claim a piece of this investment field is Trevita, based out of Cyprus. Visit their website and let me know what you think in the comments below…

A recent addition to this list of investment funds would be Valhalla Diamond Fund out of Canada, a recently launched a fund geared towards retail investors.

Sciens Capital Management also claims a piece of this field. How? Not sure, but you can visit their website and read all about it. Who is running it?

I think that by now, you have a good idea about all those that claim to have a diamond investment fund. And for the best of them all, visit: www.naturaldiamondinvestments.com and decide what to do. Humor me and let me know your reaction in the comments or in an email!

If you are really interested in investing in a diamond based financial product, let us know, and we will direct you in the right way to a secure fund.

Buying an Investment Diamond

The last way to invest in diamonds is investing directly in the physical diamonds. Buying individual diamonds is one of the safest ways of diversifying into this industry.

For centuries, people have turned to diamonds as a method of wealth condensation and wealth transportation. However, in the last few decades, as the popularity of certain diamonds has significantly increased and education about their investment benefits better known, the concept of diamonds as an investment has arisen in a big way. The most notable has been the big-ticket fancy color diamonds that are sold by auction houses such as Sotheby’s and Christie’s. These diamonds time and again earn incredible prices per carat at auction, shattering previously set records and continually gaining in value and helping increase overall value for stones of those colors in the market as a whole. While by no means are all diamonds sold in this manner, it most definitely has an effect on the mood and approach that the world markets take toward these stones.

However, it is important to remember a few important points about this method of diamond investment. First and foremost, the most important is that not all diamonds are investment grade diamonds. Only a diamond investment specialist is qualified to tell you whether a diamond is investment worthy. The measure of a properly informed diamond investment specialist is whether he can explain why the diamond at hand is investment worthy. As diamonds actually occur naturally in all colors of the rainbow, and also appear in a completely colorless variety with which most of the world is familiar, it is important for investors to know that not all colors are equally valued and equally in demand by the market, and some diamonds are not an investment at all. This goes beyond an understanding of the 4 C’s an actually extends to knowledge about the price trends of the most demanded colors and carat sizes, and to what extent their values have appreciated. In general, a diamond investment expert will recommend investing in fancy vivid pink and fancy vivid blue diamonds in as large a size as your budget can allow, although this is not a steadfast rule. Another measure of a proper diamond investment expert is whether they actually have access to investment worthy diamonds. Traditionally, these diamonds have been bought and traded by a select few, and not just any diamond dealer has access to diamonds of the highest caliber. Many will claim to be able to provide you with an investment diamond, but few can deliver on that promise.

Second, this kind of investment is only a long term investment, and the recommended strategy is a buy and hold strategy for a period of at least 20 years. This means that only people who are able to set aside this significant sum of money that is required for this investment, and won’t need that money at hand in the near future, would be able to invest. While it is possible to earn a good return on an investment grade diamond in 5 years or less, the likelihood that an investment grade diamond’s value will rise increases significantly over a longer period of time.

Third, one of the great benefits of privately owning an investment diamond is the control of the diamond in its entirety. That means that you alone will control when it will be resold, if at all, which allows you the freedom of passing it on as a heritage, and the security that as a universal asset worldwide, it will always be redeemable for its true value regardless of where it is ultimately resold. This fact is very appealing and a big draw for private diamond investments.

The Blue Moon diamond, the biggest headline making diamond of the past year

Several questions arise:

Where do I buy?

What do I buy?

When should I buy?

How do I dispose of the diamond in the future?

We have written many articles about this subject. Feel free to contact to further discuss your specific details!

Regardless of the diamond investment method that you choose, be very informed about the pros and cons of that decision. One of the safest ways to invest in diamonds, which also gives you the most control, is to buy an investment diamond privately and directly. That is why this method is so popular amongst the people who choose to invest in diamonds. That being said, there is no one-size-fits-all solution and qualities that may be a priority for you would not be the same priorities for another investor. However, diamond investments are without a doubt the most lucrative addition to a properly diversified investment portfolio that exists in the world today. We have written extensively about the incredible returns that fancy color investment grade diamonds earn over a long term investment period, especially in comparison to some of the safest and best earning investments that exist. That is how we can decisively recommend fancy color diamonds as an investment and are happy to answer any questions that you may have about the different investment channels!

Ask away in the comments, or contact us via email for more information!

Related Posts

- What Is So Extraordinary About The 2018 Argyle Tender?

- Do Collectible Cars Withstand Wealth Concentration Conditions and Requirements?

- Fancy Green Diamonds: Their Mystical And Hidden Value

- Of All Passion Investments That Sell At Auction, Do Buyers Spend the Most On Fancy Color Diamonds?

- If I Had A Crystal Ball, What Diamonds Would I Have Invested In 10 Years Ago?

Leave a Reply

You must be logged in to post a comment.

How to Invest in Diamonds

Life is about choices. Whether business related or non-business related, in most situations in life we are generally presented with three scenarios from which to choose, and of which we most likely select the route with which we are most comfortable. Investing in diamonds is no exception to this rule. There are three main ways of investing in diamonds: acquiring the physical diamond directly, investing in financial instruments backed by the physical diamonds, such as diamond funds, and investing in diamond mining companies. If you are reading this article, chances are that the thought of investing in diamonds has crossed your mind before, and this interests you enough to discover further about it. Let’s review each method with its own benefits and challenges (in no particular order). Got any questions about any of these channels when you are done reading about them? Contact us and we will be happy to address any questions that you may have!

A loose diamond laid out for observation together with a diamond tweezer

Investing in Diamond Mining Companies

For the purpose of analyzing diamond producing companies, I will focus on the seven major mining companies that recently joined forces and created the Diamond Producers Association (DPA). It goes without saying that many other diamond mining companies exist, although you would probably not choose to invest in one of them as they are not one of the main seven.

Back in March 2015, mining giant Rio Tinto and the six other major mining companies (Alrosa, De Beers, Dominion Diamonds, Lucara Diamonds, Petra Diamonds and Gem diamonds), who collectively represent over 90% of global diamond supply, met in privacy in London to discuss and review the state of the diamond industry because after a few months of prolonged supply decline. In order to repair the damage, the decision was made to create the ‘Diamond Producers Association’, a body to represent the diamond mining companies, who would put efforts together to promote diamonds as a generic product to the public in order to increase demand. By doing so, the mining companies hope to help the industry as a whole. In order to accomplish this, each has deposited seed money and together have created a $6 million fund to help educate consumers again about the benefits and the magic of diamonds. By the end of May 2015, the association was a legal entity based in London. All companies had publicized a unified press release describing their vision and ultimate goal.

The DPA explained that its mandate will include:

• Maintaining and enhancing consumer demand for and confidence in diamonds, including joint-category marketing initiatives

• Providing a reliable source of industry information, including trade and consumer research

• Acting as the unified voice of the diamond producers, when required and/or appropriate, with industry and non-industry forums/organizations

• Communicating the role and contribution of diamond producers to the diamond sector and broader society

• Sharing best practices in health and safety, license to operate, supply chain integrity and environmental management.

The Members of the Diamond Producers Association

As an investor, it is a personal choice whether you prefer to choose this method of diamond investment or any of the other two options. However, this channel is most similar to investing in any profitable company, except that the field is narrowed down to companies that produce diamonds. That being said, if that the is type of investment that you would be most comfortable with, as it may be the most familiar to you, this would be a great way for you to invest in diamonds. This is the farthest removed investment from the diamonds that is possible while still being a diamond investment. Out of these 7 companies, Alrosa produces by far the largest carat weight of diamonds annually, and Rio Tinto is the leader in both brand recognition and sales. However, in order for you to choose properly in which companies to invest, a proper financial analysis is recommended.

Investing in Diamond Backed Financial Instruments (Diamond Funds)

Unfortunately, most diamond funds are closed to the broader public, so the information below is as best as we can provide.

Many attempts have been tried to start a diamond fund by various entities over the years, and most have failed. Why? Not because diamonds are not a good investment, and not because the fund manager has not had investment experience under his belt.

The most common reason why diamonds funds fail is because the fund manager does not know how the asset (diamonds) are purchased, sold, traded.

Most of the attempts to open and run a diamond fund have been made by the financial industry. Only the combined efforts of diamond experts who trade in diamonds for a living and of financial experts can properly manage a diamond fund, since diamond experts know how these assets behave, how to sell them and how to buy them in order to maximize the returns for investors. For example, an energy specialist who may not be a CFA can manage an energy fund, but the best CFA in the world will never be able to maximize returns on an energy fund, since that CFA most likely has general knowledge in fund management but does not know what energy should be purchased for, sold for, and where we can extract the most value for investors. Diamonds are a similar case. The fund would need an expert trader in order to succeed. This is especially the case for fancy color diamonds, as they make up only 0.01% of annual global diamond supply, and of that 0.01%, only a minute amount are investment grade fancy color diamonds, mostly pink, blue, red and yellow diamonds.

Diamond Funds to Consider

I have found a handful of diamond funds that claim they have a diamond fund. Novel Asset Management is one of the funds, other funds are run by devanx.ch, Scarabaeus in Europe, Finanz Konzept AG and Pink Iguana PLC. Diamond Asset Advisors AG out of Zurich also claims a piece of this industry.

The most transparent of all, in my opinion is Finanz Konzept AG. It is the only one offering regular updates on the fund, and its performance. It may or may not be a top performer, but at least it is the most transparent.

Pink Iguana PLC was established with the help of the Asscher family, who have been involved within the diamond industry for over 150 years. No information is available online about Pink Iguana except for a landing page. In my opinion, a minimum of information must be open to the public in order to be trustworthy.

Devanx claims it has been able to track sales of red diamonds for the last 50 years. It also helps investors get their hands on these assets. The company also presents to potential investors 5 key exit strategies.

Image courtesy of Devanx

Scarabaeus Wealth Management of Liechtenstein offers various investment funds to its clients. Newly created fund invests in diamonds. It has a special arrangement with La Serla for the acquisition and disposition of diamonds.

Novel Asset Management is headed by Alan Landau as its CEO, a veteran in the investment community, and Chief Investment Officer Eliad Cohen, who has been in the diamond industry for over a decade. This company is backed by Novel Collection, a 20+ year company within the diamond industry trading in Fancy Color Diamonds.

Diamond Asset Advisors AG out of Zurich also claims a chunk of this business, most recently striking a deal with the De Beers network of stores. From my understanding, they are involved in financing purchases made from the De Beers stores. It is headed by Dr. Peter Laib, a veteran in the private equity investment world.

Diamond Capital Fund is yet another entity claiming to be involved in the diamond investment fund world. Visit their website and be the judge if this is something you would ever want to be involved with.

Another company to claim a piece of this investment field is Trevita, based out of Cyprus. Visit their website and let me know what you think in the comments below…

A recent addition to this list of investment funds would be Valhalla Diamond Fund out of Canada, a recently launched a fund geared towards retail investors.

Sciens Capital Management also claims a piece of this field. How? Not sure, but you can visit their website and read all about it. Who is running it?

I think that by now, you have a good idea about all those that claim to have a diamond investment fund. And for the best of them all, visit: www.naturaldiamondinvestments.com and decide what to do. Humor me and let me know your reaction in the comments or in an email!

If you are really interested in investing in a diamond based financial product, let us know, and we will direct you in the right way to a secure fund.

Buying an Investment Diamond

The last way to invest in diamonds is investing directly in the physical diamonds. Buying individual diamonds is one of the safest ways of diversifying into this industry.

For centuries, people have turned to diamonds as a method of wealth condensation and wealth transportation. However, in the last few decades, as the popularity of certain diamonds has significantly increased and education about their investment benefits better known, the concept of diamonds as an investment has arisen in a big way. The most notable has been the big-ticket fancy color diamonds that are sold by auction houses such as Sotheby’s and Christie’s. These diamonds time and again earn incredible prices per carat at auction, shattering previously set records and continually gaining in value and helping increase overall value for stones of those colors in the market as a whole. While by no means are all diamonds sold in this manner, it most definitely has an effect on the mood and approach that the world markets take toward these stones.

However, it is important to remember a few important points about this method of diamond investment. First and foremost, the most important is that not all diamonds are investment grade diamonds. Only a diamond investment specialist is qualified to tell you whether a diamond is investment worthy. The measure of a properly informed diamond investment specialist is whether he can explain why the diamond at hand is investment worthy. As diamonds actually occur naturally in all colors of the rainbow, and also appear in a completely colorless variety with which most of the world is familiar, it is important for investors to know that not all colors are equally valued and equally in demand by the market, and some diamonds are not an investment at all. This goes beyond an understanding of the 4 C’s an actually extends to knowledge about the price trends of the most demanded colors and carat sizes, and to what extent their values have appreciated. In general, a diamond investment expert will recommend investing in fancy vivid pink and fancy vivid blue diamonds in as large a size as your budget can allow, although this is not a steadfast rule. Another measure of a proper diamond investment expert is whether they actually have access to investment worthy diamonds. Traditionally, these diamonds have been bought and traded by a select few, and not just any diamond dealer has access to diamonds of the highest caliber. Many will claim to be able to provide you with an investment diamond, but few can deliver on that promise.

Second, this kind of investment is only a long term investment, and the recommended strategy is a buy and hold strategy for a period of at least 20 years. This means that only people who are able to set aside this significant sum of money that is required for this investment, and won’t need that money at hand in the near future, would be able to invest. While it is possible to earn a good return on an investment grade diamond in 5 years or less, the likelihood that an investment grade diamond’s value will rise increases significantly over a longer period of time.

Third, one of the great benefits of privately owning an investment diamond is the control of the diamond in its entirety. That means that you alone will control when it will be resold, if at all, which allows you the freedom of passing it on as a heritage, and the security that as a universal asset worldwide, it will always be redeemable for its true value regardless of where it is ultimately resold. This fact is very appealing and a big draw for private diamond investments.

The Blue Moon diamond, the biggest headline making diamond of the past year

Several questions arise:

Where do I buy?

What do I buy?

When should I buy?

How do I dispose of the diamond in the future?

We have written many articles about this subject. Feel free to contact to further discuss your specific details!

Regardless of the diamond investment method that you choose, be very informed about the pros and cons of that decision. One of the safest ways to invest in diamonds, which also gives you the most control, is to buy an investment diamond privately and directly. That is why this method is so popular amongst the people who choose to invest in diamonds. That being said, there is no one-size-fits-all solution and qualities that may be a priority for you would not be the same priorities for another investor. However, diamond investments are without a doubt the most lucrative addition to a properly diversified investment portfolio that exists in the world today. We have written extensively about the incredible returns that fancy color investment grade diamonds earn over a long term investment period, especially in comparison to some of the safest and best earning investments that exist. That is how we can decisively recommend fancy color diamonds as an investment and are happy to answer any questions that you may have about the different investment channels!

Ask away in the comments, or contact us via email for more information!

Related Posts

- What Is So Extraordinary About The 2018 Argyle Tender?

- Do Collectible Cars Withstand Wealth Concentration Conditions and Requirements?

- Fancy Green Diamonds: Their Mystical And Hidden Value

- Of All Passion Investments That Sell At Auction, Do Buyers Spend the Most On Fancy Color Diamonds?

- Fancy Color Diamonds to remain the top Wealth Concentration Investment Vehicle

Leave a Reply

You must be logged in to post a comment.