Will the Pink Star Diamond New Partnership make Sotheby’s Share Price a Rising Star Again?

It all started back in November 2013, at the Geneva auction. Sotheby’s was set to sell the largest Fancy Vivid Pink Diamond (which is still up to this day). The bidding Started at $48 million Swiss Francs and lasted a few minutes. There were 2-3 last bidders still standing, but the final bid of $68 million Swiss francs ($74.3 million USD) made the winner, famous Diamond dealer, Isaac Wolf, and his financial backers, quite happy. They thought they got a bargain. With commission and fees, the final price was $83.4 million dollars.

The Pink Star History

The Pink Star was found in Africa back in 1999. It was 132.5 carats in the rough. It took Steinmetz Diamonds two years to properly plan and polish it to its final weight of 59.6 carats. It was graded as a Fancy Vivid Pink. In May 2003 it was revealed to the world as the “Steinmetz Pink” and was displayed at a museum. The diamond was first sold, and then went back to its owner, when the buyer defaulted on his payment. Steinmetz then resold it as a partnership at a value of $25 million and renamed it the “Pink Star”.

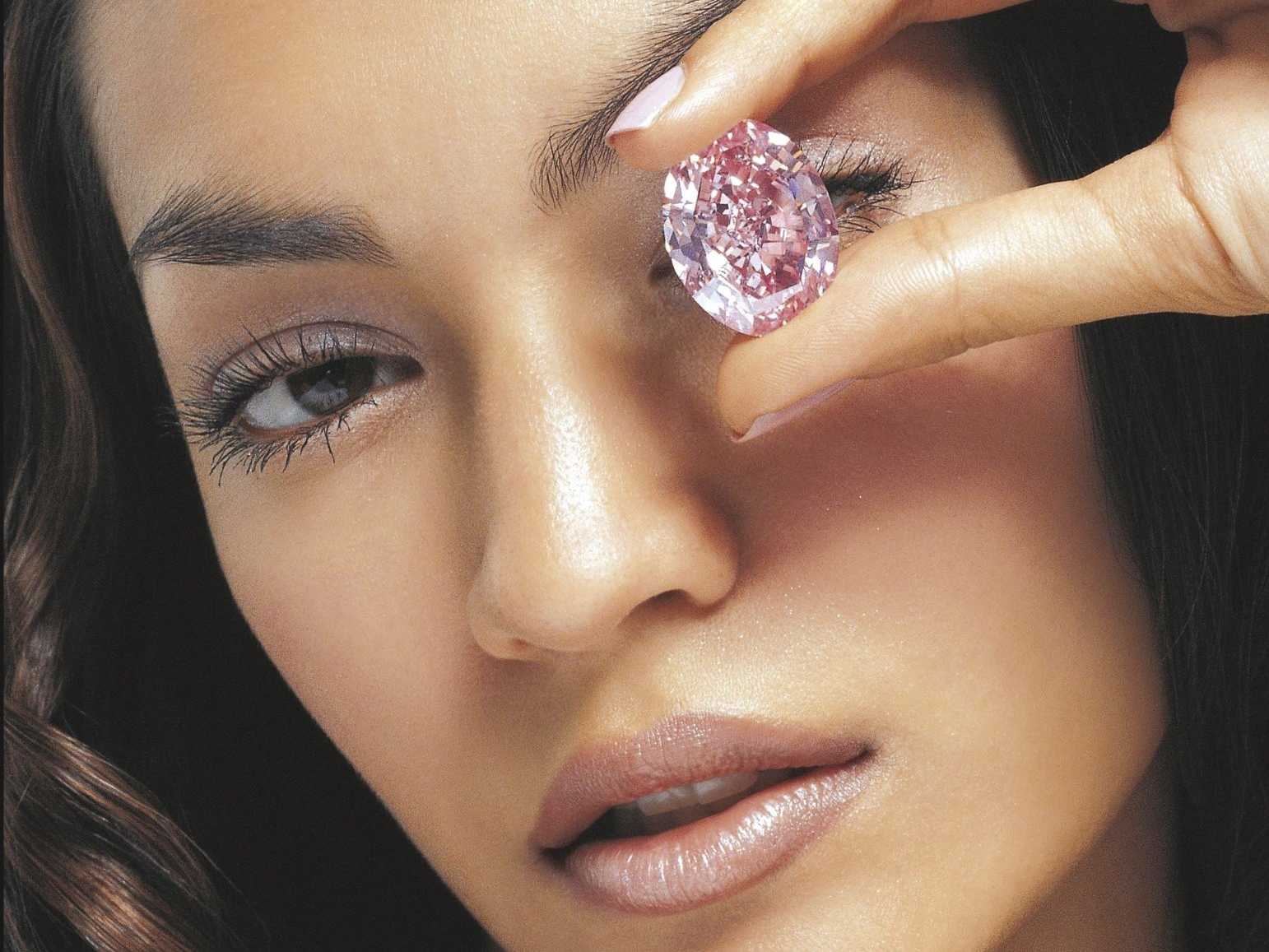

Understanding how large the 59.60 carat Pink Star is in reality Image Courtesy: Sotheby’s

Public Announcement

In late February 2014, Sotheby’s had to make a public announcement that the Buyer, Isaac Wolf has defaulted on his payment. The question that we might ask, why take three months to announce the default? why not go back to the 2nd in line bidder and make a deal? what went wrong here?

Sotheby’s had secured the Pink Star with a guaranteed $60 million payment. Sotheby’s had to make a public announcement because they are a publicly traded company and such a transaction was material to their financial statements. Sotheby’s had to book the Pink Star as an inventory item, and booked it as a $72 million asset. why $72 million? why not $60 million? is it not the actual price they paid for the asset to secure it? it was just done, was it not? in a matter of a few weeks it managed to gain a 20% increase in value?

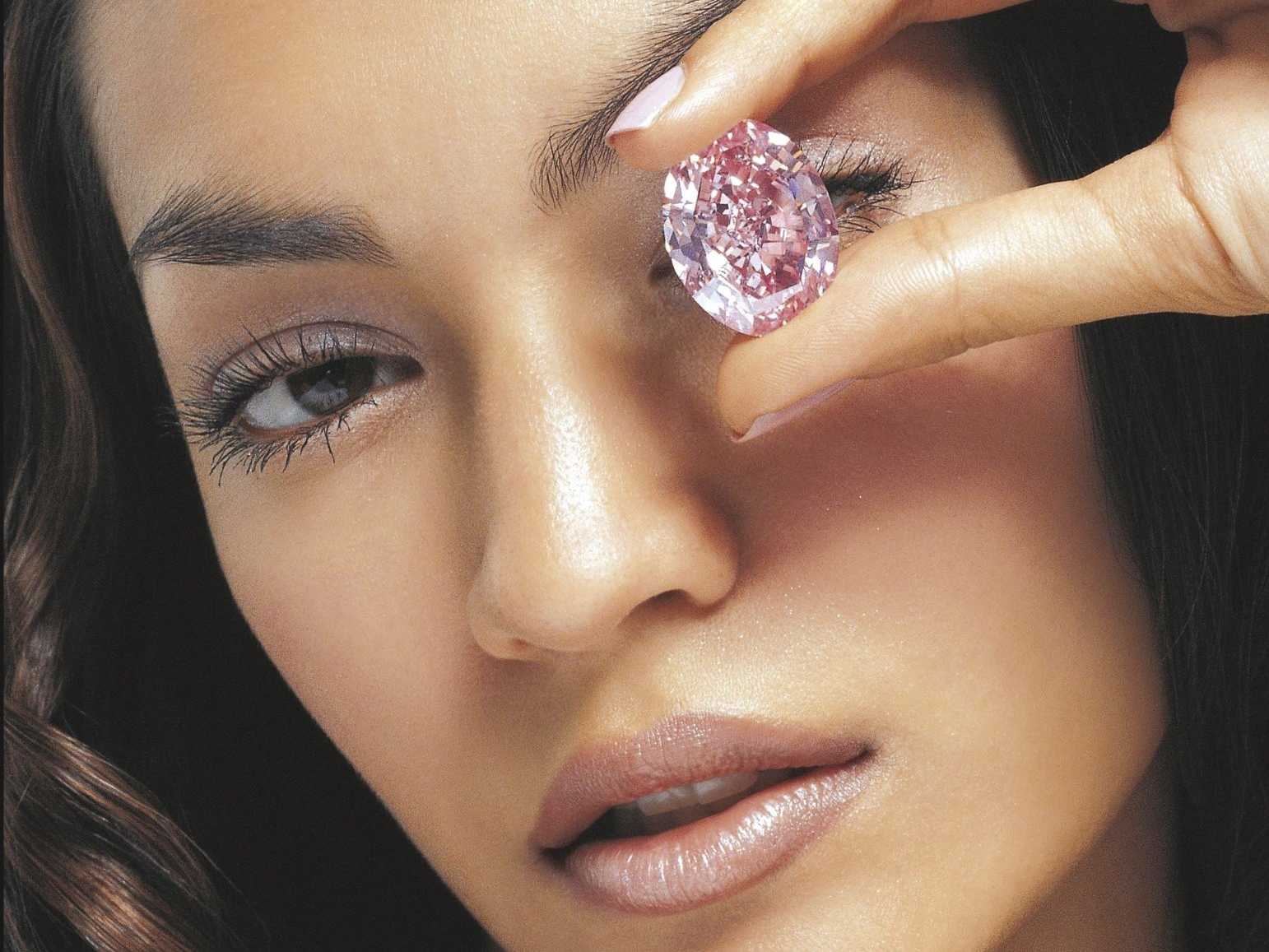

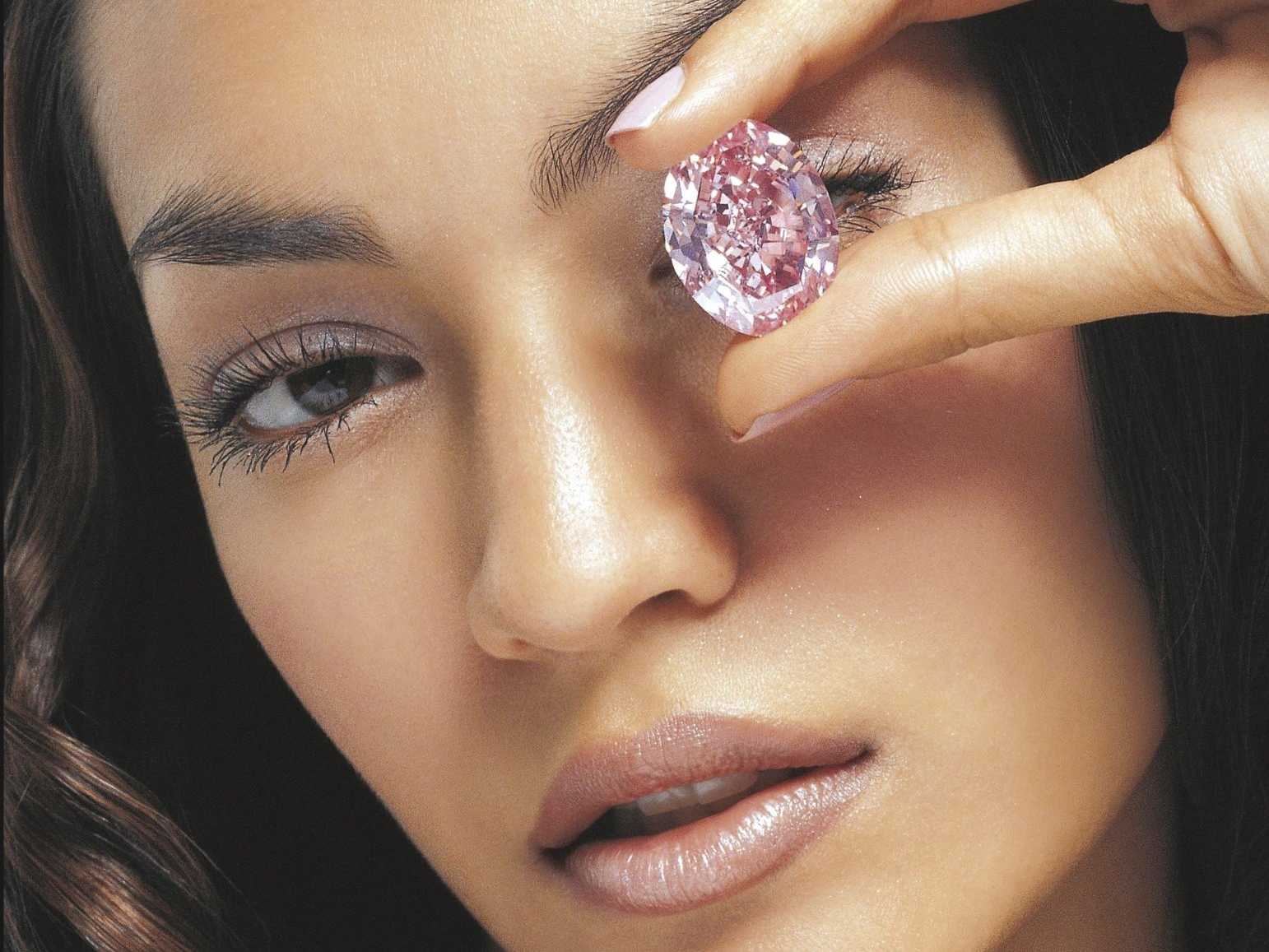

The Last Bid given right before the hammer goes down for the Pink Star Image Courtesy: Reuters/Denis Balibouse

Did the Buyer really default?

Up to now, the market was under the impression that the buyer has defaulted on his payment, which is the formal claim. In reality, did the buyer really default? was Sotheby’s fully transparent with its investors and with the market? our investigation tells a different story!

Our sources tell us that the buyer indeed made a wire transfer to Sotheby’s, from a european bank, but Sotheby’s declined the payment claiming that the financial institution from where the payment came from was questionable. As Sotheby’s is a public company, and that their shares are traded on an American Stock Exchange, the transaction failed to be fully transparent.

That is why Sotheby’s may have tried to re-negotiate with the buyer to wire the money from a different institution. But why should he? Who is responsible for the KYC (Know Your Client) rule? Sotheby’s? The bank that wired the money? If the bank wired the money, how did the buyer give that bank the money? did he just walk into the bank and give them $83.4 million in cash, and asked for a deposit receipt?

Why has Isaac Wolf kept quiet?

Where has Isaac Wolf Disappear to? Image Courtesy: Channel 10 Israel

Who is Sotheby’s Diamonds?

Sotheby’s Diamonds, as the website claims, is a partnership between Sotheby’s, the auction house, and no other than Diacore, formerly Steinmetz Diamonds, surprised?

Wasn’t the Pink Star just sold to a trio partnership including Sotheby’s, Diacore and a 3rd party? What is the connection between this transaction, and the initial sale, of which Sotheby’s gave the guarantee to? The last we know, Steinmetz sold a partnership into the Pink Star for a value of $25 million. and now the same entity (just rebranded as Diacore) is buying back into the Diamond? is this at arm’s length? why are the details of the deal not more transparent? especially when some of the parties are more “intimately” involved…

The Pink Star on display with other Famous Diamonds Image Courtesy: The Smithsonian

Is it a SPV in disguise?

Has Sotheby’s just created an SPV (Special Purpose Vehicle), but called it partnership? let’s look at the numbers:

Sotheby’s guaranteed $60 million and paid, therefore they are $60 million in the hole. Sotheby’s then puts the value on the books at $72 million, creating a surplus value (or goodwill) of $12 million. Assuming they sold the partnership on an equal basis 3 way (details were not made public), makes each part worth $24 million. Sotheby’s got a $48 million payment from the parties, so their remaining liability is at $12 million, based on the $60 million actually paid. but, based on the value of the Pink Star actually placed on the books at $72 million, where $12 million is goodwill…now we have the $12 million liability which is eliminated with the $12 million goodwill, and which eliminated the balance of the liability off the books completely.

Now, the full liability of $60 million is off Sotheby’s books. Is this the reason why their share price has been on a down spiral since the famous night where it was sold? was this liability hampering on the share price, even though sales have increased?

See the chart below: Around the time the Pink Star was sold, the share price peaked for the last 5 years. Ever since, it has been on a down trend. Will it now start going up?

Sotheby’s Share performance since the sale of the Pink Star Courtesy: Yahoo Finance

Pink Star will make History

The Pink Star will surely make history with its Provenance Report…

What is the real story behind the Pink Star? and more interesting is what will happen now? who will potentially acquire the diamond? will it be put on public display? or will it disappear and reappear in 25 or even 50 years?

Another question to be asked is why sell into a partnership now? have the 2 partners got a buyer waiting?

I think that Sotheby’s owes us further explanation, especially to its shareholders.

What do you think?

Related Posts

- The Lost Luster Of Unsold Diamonds At Auction

- Geneva Auctions Heating Up With Major Announcement by Sotheby’s

- Recent Sotheby’s New York Auction, Disappointing To Some, Fantastic Outcome To Others…

- Bonham’s To Break Its Way in London with Rare Fancy Intense Blue Diamond

- Blue & Pink Diamonds Highlights Of Fall Auction Season In New York

Will the Pink Star Diamond New Partnership make Sotheby’s Share Price a Rising Star Again?

It all started back in November 2013, at the Geneva auction. Sotheby’s was set to sell the largest Fancy Vivid Pink Diamond (which is still up to this day). The bidding Started at $48 million Swiss Francs and lasted a few minutes. There were 2-3 last bidders still standing, but the final bid of $68 million Swiss francs ($74.3 million USD) made the winner, famous Diamond dealer, Isaac Wolf, and his financial backers, quite happy. They thought they got a bargain. With commission and fees, the final price was $83.4 million dollars.

The Pink Star History

The Pink Star was found in Africa back in 1999. It was 132.5 carats in the rough. It took Steinmetz Diamonds two years to properly plan and polish it to its final weight of 59.6 carats. It was graded as a Fancy Vivid Pink. In May 2003 it was revealed to the world as the “Steinmetz Pink” and was displayed at a museum. The diamond was first sold, and then went back to its owner, when the buyer defaulted on his payment. Steinmetz then resold it as a partnership at a value of $25 million and renamed it the “Pink Star”.

Understanding how large the 59.60 carat Pink Star is in reality Image Courtesy: Sotheby’s

Public Announcement

In late February 2014, Sotheby’s had to make a public announcement that the Buyer, Isaac Wolf has defaulted on his payment. The question that we might ask, why take three months to announce the default? why not go back to the 2nd in line bidder and make a deal? what went wrong here?

Sotheby’s had secured the Pink Star with a guaranteed $60 million payment. Sotheby’s had to make a public announcement because they are a publicly traded company and such a transaction was material to their financial statements. Sotheby’s had to book the Pink Star as an inventory item, and booked it as a $72 million asset. why $72 million? why not $60 million? is it not the actual price they paid for the asset to secure it? it was just done, was it not? in a matter of a few weeks it managed to gain a 20% increase in value?

The Last Bid given right before the hammer goes down for the Pink Star Image Courtesy: Reuters/Denis Balibouse

Did the Buyer really default?

Up to now, the market was under the impression that the buyer has defaulted on his payment, which is the formal claim. In reality, did the buyer really default? was Sotheby’s fully transparent with its investors and with the market? our investigation tells a different story!

Our sources tell us that the buyer indeed made a wire transfer to Sotheby’s, from a european bank, but Sotheby’s declined the payment claiming that the financial institution from where the payment came from was questionable. As Sotheby’s is a public company, and that their shares are traded on an American Stock Exchange, the transaction failed to be fully transparent.

That is why Sotheby’s may have tried to re-negotiate with the buyer to wire the money from a different institution. But why should he? Who is responsible for the KYC (Know Your Client) rule? Sotheby’s? The bank that wired the money? If the bank wired the money, how did the buyer give that bank the money? did he just walk into the bank and give them $83.4 million in cash, and asked for a deposit receipt?

Why has Isaac Wolf kept quiet?

Where has Isaac Wolf Disappear to? Image Courtesy: Channel 10 Israel

Who is Sotheby’s Diamonds?

Sotheby’s Diamonds, as the website claims, is a partnership between Sotheby’s, the auction house, and no other than Diacore, formerly Steinmetz Diamonds, surprised?

Wasn’t the Pink Star just sold to a trio partnership including Sotheby’s, Diacore and a 3rd party? What is the connection between this transaction, and the initial sale, of which Sotheby’s gave the guarantee to? The last we know, Steinmetz sold a partnership into the Pink Star for a value of $25 million. and now the same entity (just rebranded as Diacore) is buying back into the Diamond? is this at arm’s length? why are the details of the deal not more transparent? especially when some of the parties are more “intimately” involved…

The Pink Star on display with other Famous Diamonds Image Courtesy: The Smithsonian

Is it a SPV in disguise?

Has Sotheby’s just created an SPV (Special Purpose Vehicle), but called it partnership? let’s look at the numbers:

Sotheby’s guaranteed $60 million and paid, therefore they are $60 million in the hole. Sotheby’s then puts the value on the books at $72 million, creating a surplus value (or goodwill) of $12 million. Assuming they sold the partnership on an equal basis 3 way (details were not made public), makes each part worth $24 million. Sotheby’s got a $48 million payment from the parties, so their remaining liability is at $12 million, based on the $60 million actually paid. but, based on the value of the Pink Star actually placed on the books at $72 million, where $12 million is goodwill…now we have the $12 million liability which is eliminated with the $12 million goodwill, and which eliminated the balance of the liability off the books completely.

Now, the full liability of $60 million is off Sotheby’s books. Is this the reason why their share price has been on a down spiral since the famous night where it was sold? was this liability hampering on the share price, even though sales have increased?

See the chart below: Around the time the Pink Star was sold, the share price peaked for the last 5 years. Ever since, it has been on a down trend. Will it now start going up?

Sotheby’s Share performance since the sale of the Pink Star Courtesy: Yahoo Finance

Pink Star will make History

The Pink Star will surely make history with its Provenance Report…

What is the real story behind the Pink Star? and more interesting is what will happen now? who will potentially acquire the diamond? will it be put on public display? or will it disappear and reappear in 25 or even 50 years?

Another question to be asked is why sell into a partnership now? have the 2 partners got a buyer waiting?

I think that Sotheby’s owes us further explanation, especially to its shareholders.

What do you think?

Related Posts

- The Lost Luster Of Unsold Diamonds At Auction

- Geneva Auctions Heating Up With Major Announcement by Sotheby’s

- Recent Sotheby’s New York Auction, Disappointing To Some, Fantastic Outcome To Others…

- Bonham’s To Break Its Way in London with Rare Fancy Intense Blue Diamond

- Blue & Pink Diamonds Highlights Of Fall Auction Season In New York

Leave a Reply

You must be logged in to post a comment.

Will the Pink Star Diamond New Partnership make Sotheby’s Share Price a Rising Star Again?

It all started back in November 2013, at the Geneva auction. Sotheby’s was set to sell the largest Fancy Vivid Pink Diamond (which is still up to this day). The bidding Started at $48 million Swiss Francs and lasted a few minutes. There were 2-3 last bidders still standing, but the final bid of $68 million Swiss francs ($74.3 million USD) made the winner, famous Diamond dealer, Isaac Wolf, and his financial backers, quite happy. They thought they got a bargain. With commission and fees, the final price was $83.4 million dollars.

The Pink Star History

The Pink Star was found in Africa back in 1999. It was 132.5 carats in the rough. It took Steinmetz Diamonds two years to properly plan and polish it to its final weight of 59.6 carats. It was graded as a Fancy Vivid Pink. In May 2003 it was revealed to the world as the “Steinmetz Pink” and was displayed at a museum. The diamond was first sold, and then went back to its owner, when the buyer defaulted on his payment. Steinmetz then resold it as a partnership at a value of $25 million and renamed it the “Pink Star”.

Understanding how large the 59.60 carat Pink Star is in reality Image Courtesy: Sotheby’s

Public Announcement

In late February 2014, Sotheby’s had to make a public announcement that the Buyer, Isaac Wolf has defaulted on his payment. The question that we might ask, why take three months to announce the default? why not go back to the 2nd in line bidder and make a deal? what went wrong here?

Sotheby’s had secured the Pink Star with a guaranteed $60 million payment. Sotheby’s had to make a public announcement because they are a publicly traded company and such a transaction was material to their financial statements. Sotheby’s had to book the Pink Star as an inventory item, and booked it as a $72 million asset. why $72 million? why not $60 million? is it not the actual price they paid for the asset to secure it? it was just done, was it not? in a matter of a few weeks it managed to gain a 20% increase in value?

The Last Bid given right before the hammer goes down for the Pink Star Image Courtesy: Reuters/Denis Balibouse

Did the Buyer really default?

Up to now, the market was under the impression that the buyer has defaulted on his payment, which is the formal claim. In reality, did the buyer really default? was Sotheby’s fully transparent with its investors and with the market? our investigation tells a different story!

Our sources tell us that the buyer indeed made a wire transfer to Sotheby’s, from a european bank, but Sotheby’s declined the payment claiming that the financial institution from where the payment came from was questionable. As Sotheby’s is a public company, and that their shares are traded on an American Stock Exchange, the transaction failed to be fully transparent.

That is why Sotheby’s may have tried to re-negotiate with the buyer to wire the money from a different institution. But why should he? Who is responsible for the KYC (Know Your Client) rule? Sotheby’s? The bank that wired the money? If the bank wired the money, how did the buyer give that bank the money? did he just walk into the bank and give them $83.4 million in cash, and asked for a deposit receipt?

Why has Isaac Wolf kept quiet?

Where has Isaac Wolf Disappear to? Image Courtesy: Channel 10 Israel

Who is Sotheby’s Diamonds?

Sotheby’s Diamonds, as the website claims, is a partnership between Sotheby’s, the auction house, and no other than Diacore, formerly Steinmetz Diamonds, surprised?

Wasn’t the Pink Star just sold to a trio partnership including Sotheby’s, Diacore and a 3rd party? What is the connection between this transaction, and the initial sale, of which Sotheby’s gave the guarantee to? The last we know, Steinmetz sold a partnership into the Pink Star for a value of $25 million. and now the same entity (just rebranded as Diacore) is buying back into the Diamond? is this at arm’s length? why are the details of the deal not more transparent? especially when some of the parties are more “intimately” involved…

The Pink Star on display with other Famous Diamonds Image Courtesy: The Smithsonian

Is it a SPV in disguise?

Has Sotheby’s just created an SPV (Special Purpose Vehicle), but called it partnership? let’s look at the numbers:

Sotheby’s guaranteed $60 million and paid, therefore they are $60 million in the hole. Sotheby’s then puts the value on the books at $72 million, creating a surplus value (or goodwill) of $12 million. Assuming they sold the partnership on an equal basis 3 way (details were not made public), makes each part worth $24 million. Sotheby’s got a $48 million payment from the parties, so their remaining liability is at $12 million, based on the $60 million actually paid. but, based on the value of the Pink Star actually placed on the books at $72 million, where $12 million is goodwill…now we have the $12 million liability which is eliminated with the $12 million goodwill, and which eliminated the balance of the liability off the books completely.

Now, the full liability of $60 million is off Sotheby’s books. Is this the reason why their share price has been on a down spiral since the famous night where it was sold? was this liability hampering on the share price, even though sales have increased?

See the chart below: Around the time the Pink Star was sold, the share price peaked for the last 5 years. Ever since, it has been on a down trend. Will it now start going up?

Sotheby’s Share performance since the sale of the Pink Star Courtesy: Yahoo Finance

Pink Star will make History

The Pink Star will surely make history with its Provenance Report…

What is the real story behind the Pink Star? and more interesting is what will happen now? who will potentially acquire the diamond? will it be put on public display? or will it disappear and reappear in 25 or even 50 years?

Another question to be asked is why sell into a partnership now? have the 2 partners got a buyer waiting?

I think that Sotheby’s owes us further explanation, especially to its shareholders.

What do you think?

Related Posts

- The Lost Luster Of Unsold Diamonds At Auction

- Geneva Auctions Heating Up With Major Announcement by Sotheby’s

- Recent Sotheby’s New York Auction, Disappointing To Some, Fantastic Outcome To Others…

- Bonham’s To Break Its Way in London with Rare Fancy Intense Blue Diamond

- Blue & Pink Diamonds Highlights Of Fall Auction Season In New York

Leave a Reply

You must be logged in to post a comment.