Investors Have a Sweet Tooth for Chocolate and Fancy Color Diamonds

Not too long ago, I was waiting for the call to board the plane to South Africa to go visit the Cullinan mine. I was reading the local business newspaper, and to my amusement, I read that the only other commodity that actually went up in value during 2015 other than Fancy Color Diamonds was cocoa. I must be honest, this information took me by surprise, and after nearly two months, I finally had the opportunity to further investigate this (it stuck in my head this whole time). It felt especially apropos at this time seeing as how Valentine’s Day, the holiday of diamonds and chocolate, is upon us!

I researched the value appreciation of capital markets, other precious metals, and major corporations like Berkshire Hathaway and Coke to make the comparison and see if this claim was correct. I even asked myself what other evidence I could further bring to the investment community to prove the potential of investing in fancy color diamonds. The interesting part of this comparison is that chocolate is everyone’s favorite, no matter how the economy is doing! Everybody needs some sweets, regardless of whether it is during a bitter economic time or during happy events throughout the year. If chocolate is in such high demand, it is definitely possible that this claim could be correct! Of course, this would depend on the supply versus the demand for cocoa.

Picture taken of the newspaper talking about Cocoa, while waiting at the airport in South Africa

Time for Sweets

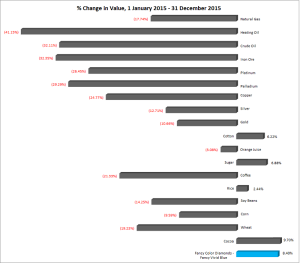

I analyzed a total of 18 commodities, ranging from grains like rice, soy beans, wheat, and corn to energy commodities like crude oil, heating oil and natural gas. I also analyzed all the basic metals like gold, silver, copper and palladium, and added basic commodities like cotton, orange juice and coffee.

The largest drop in value goes to heating oil at -41%+ from January 1, 2015 To December 31, 2015. The largest gain was in fact cocoa at +9.7% over the same time period!

The % change in value for 18 commodities, including fancy color diamonds, for the year 2015

From 18 commodities (excluding fancy color diamonds) only a mere total of 4 increased in value at all, while the other 14 actually dropped in value. The interesting part about the 4 that did increase in value is that 2 of them are related – cocoa and sugar. Obviously, to make chocolate you need both, but it is interesting to note that cocoa increased in value more than sugar (9.7% compared to 6.9% for sugar). The other 2 commodities that gained were rice (2.4%) and cotton (6.2%). Each gain has a host of explanatory economic factors, but that is beyond the scope of this article.

Chocolates in the shape of round brilliant diamonds

While it is nice to analyze past information, that is an easy task to do. The real challenge would be to assess the future potential of a commodity, and make, as some would put it, “an educated guess”. It is wisest to assess fundamentals, to look at macroeconomic factors and add the geo-political global factors, and thereby deduce the long term potential.

Many are now looking at China in exactly the opposite way that they did last year. Their stock market has crashed, manufacturing has slowed down, and GDP has dropped below the desired 7%. But in all honesty, so what? China is entering a new balance, and its double digit growth cannot go on forever. Every analyst knew that China is in the midst of transforming itself from a manufacturing hub to one of consuming. This is their longer range plan. Let’s face reality: China has a large enough population that they don’t really need to export. They can live on their own internal demand.

Let’s put that assessment that they can live on their own internal demand into perspective. I remember when a few years ago, I visited a factory in China that was producing tin based boxes. They had a room with 5 machines (about 10% of all machines), and 12 employees. They were producing 1 specific tin box, 7 days a week, for around 2 years. This specific tin was produced to package a wine bottle, a Chinese made wine, for internal consumption. The order was for 2 million tin boxes. That was for 1 product for Chinese consumption only, no exporting.

I am really not concerned about China’s economy in the long run – they are minting a new millionaire daily, and are responsible for 25% of Apple iPhone purchases. Chinese social mentality was always that of savers, and now they are transforming to that of consumers, 1.5 billion consumers to be exact! That is real power. To top it all off, the Chinese Renminbi (currency, and also known as the Yuan), is slowly but consistently and strongly becoming a global power too. I wonder when it will be close in trading to that of the US dollar. The question is not even if, but when.

As China creates more wealth in the coming years, and surpasses the all mighty USA, eventually, so too their demand and consumption of delicacies such as chocolate and fancy color diamonds will increase.

China has already proven to the world (not that they need to) that every decision they make has been done with great care, attention, and with long term vision. This is especially admirable since the majority of governments are short sighted. Look back to 1897, when China made an agreement to allow the UK to manage Hong Kong for 100 years. It seems that the UK did not anticipate the long term effect of that decision, and welcomed it with open arms. Hong Kong was developed for the following 100 years, became a power house in every sense of the word, and when it was ripe, was handed back over the China to reap all the fruits of the labor. China is very smart and looks to take great care of future generations.

Hong Kong in the early 1900s

Investors should take the same approach with fancy color diamonds. A clever investor who is looking into long term investments with huge rewards will recognize that fancy color diamonds are not typically celebrated in the investment world, which this indicates a well-kept secret of an elite few. For centuries, these diamonds were limited to the world’s upper classes as a clever method of wealth condensation and eventually, capital investment. In recent years, with the proliferation of eCommerce and investment knowledge on the internet, great interest has arisen in the long term investment potential of such stones, especially considering recent headlines in the last decade about record prices of fancy color diamonds at auction. Coupled with the fact that known supplies of fancy color diamonds are fast running out, the upturn in demand for these gems means the long term minded citizens of superpowers both old and new will all be clamoring for the same goods. Like investing wisely in commodities, such as cocoa and sugar, it takes a well-educated investor to understand where to put their money, especially if there are looking to take care of future generations. With the right guidance, you can choose an excellent fancy color diamond with investment qualities that will reap amazing rewards in the future.

What’s your opinion on the value increases/decreases on those commodities in 2015? Are you surprised that fancy color diamonds were in second place, following cocoa, for greatest increase of the year? Tell us your opinion in the comments!

Related Posts

- Wealth Concentration Index Continues Trend Despite Market Conditions

- How Did 19 Commodities Stack Up To Fancy Color Diamonds Over The Last 6 Years?

- Pink Diamonds Performing Better than Gold in Recent History

- Sotheby’s Will Try To Reignite The Love For Fancy Color Diamonds With A Unique Pair Of Hearts At The Upcoming Hong Kong Auction

- Do Jewelry Appraisers Know How To Evaluate Fancy Color Diamonds?

Investors Have a Sweet Tooth for Chocolate and Fancy Color Diamonds

Not too long ago, I was waiting for the call to board the plane to South Africa to go visit the Cullinan mine. I was reading the local business newspaper, and to my amusement, I read that the only other commodity that actually went up in value during 2015 other than Fancy Color Diamonds was cocoa. I must be honest, this information took me by surprise, and after nearly two months, I finally had the opportunity to further investigate this (it stuck in my head this whole time). It felt especially apropos at this time seeing as how Valentine’s Day, the holiday of diamonds and chocolate, is upon us!

I researched the value appreciation of capital markets, other precious metals, and major corporations like Berkshire Hathaway and Coke to make the comparison and see if this claim was correct. I even asked myself what other evidence I could further bring to the investment community to prove the potential of investing in fancy color diamonds. The interesting part of this comparison is that chocolate is everyone’s favorite, no matter how the economy is doing! Everybody needs some sweets, regardless of whether it is during a bitter economic time or during happy events throughout the year. If chocolate is in such high demand, it is definitely possible that this claim could be correct! Of course, this would depend on the supply versus the demand for cocoa.

Picture taken of the newspaper talking about Cocoa, while waiting at the airport in South Africa

Time for Sweets

I analyzed a total of 18 commodities, ranging from grains like rice, soy beans, wheat, and corn to energy commodities like crude oil, heating oil and natural gas. I also analyzed all the basic metals like gold, silver, copper and palladium, and added basic commodities like cotton, orange juice and coffee.

The largest drop in value goes to heating oil at -41%+ from January 1, 2015 To December 31, 2015. The largest gain was in fact cocoa at +9.7% over the same time period!

The % change in value for 18 commodities, including fancy color diamonds, for the year 2015

From 18 commodities (excluding fancy color diamonds) only a mere total of 4 increased in value at all, while the other 14 actually dropped in value. The interesting part about the 4 that did increase in value is that 2 of them are related – cocoa and sugar. Obviously, to make chocolate you need both, but it is interesting to note that cocoa increased in value more than sugar (9.7% compared to 6.9% for sugar). The other 2 commodities that gained were rice (2.4%) and cotton (6.2%). Each gain has a host of explanatory economic factors, but that is beyond the scope of this article.

Chocolates in the shape of round brilliant diamonds

While it is nice to analyze past information, that is an easy task to do. The real challenge would be to assess the future potential of a commodity, and make, as some would put it, “an educated guess”. It is wisest to assess fundamentals, to look at macroeconomic factors and add the geo-political global factors, and thereby deduce the long term potential.

Many are now looking at China in exactly the opposite way that they did last year. Their stock market has crashed, manufacturing has slowed down, and GDP has dropped below the desired 7%. But in all honesty, so what? China is entering a new balance, and its double digit growth cannot go on forever. Every analyst knew that China is in the midst of transforming itself from a manufacturing hub to one of consuming. This is their longer range plan. Let’s face reality: China has a large enough population that they don’t really need to export. They can live on their own internal demand.

Let’s put that assessment that they can live on their own internal demand into perspective. I remember when a few years ago, I visited a factory in China that was producing tin based boxes. They had a room with 5 machines (about 10% of all machines), and 12 employees. They were producing 1 specific tin box, 7 days a week, for around 2 years. This specific tin was produced to package a wine bottle, a Chinese made wine, for internal consumption. The order was for 2 million tin boxes. That was for 1 product for Chinese consumption only, no exporting.

I am really not concerned about China’s economy in the long run – they are minting a new millionaire daily, and are responsible for 25% of Apple iPhone purchases. Chinese social mentality was always that of savers, and now they are transforming to that of consumers, 1.5 billion consumers to be exact! That is real power. To top it all off, the Chinese Renminbi (currency, and also known as the Yuan), is slowly but consistently and strongly becoming a global power too. I wonder when it will be close in trading to that of the US dollar. The question is not even if, but when.

As China creates more wealth in the coming years, and surpasses the all mighty USA, eventually, so too their demand and consumption of delicacies such as chocolate and fancy color diamonds will increase.

China has already proven to the world (not that they need to) that every decision they make has been done with great care, attention, and with long term vision. This is especially admirable since the majority of governments are short sighted. Look back to 1897, when China made an agreement to allow the UK to manage Hong Kong for 100 years. It seems that the UK did not anticipate the long term effect of that decision, and welcomed it with open arms. Hong Kong was developed for the following 100 years, became a power house in every sense of the word, and when it was ripe, was handed back over the China to reap all the fruits of the labor. China is very smart and looks to take great care of future generations.

Hong Kong in the early 1900s

Investors should take the same approach with fancy color diamonds. A clever investor who is looking into long term investments with huge rewards will recognize that fancy color diamonds are not typically celebrated in the investment world, which this indicates a well-kept secret of an elite few. For centuries, these diamonds were limited to the world’s upper classes as a clever method of wealth condensation and eventually, capital investment. In recent years, with the proliferation of eCommerce and investment knowledge on the internet, great interest has arisen in the long term investment potential of such stones, especially considering recent headlines in the last decade about record prices of fancy color diamonds at auction. Coupled with the fact that known supplies of fancy color diamonds are fast running out, the upturn in demand for these gems means the long term minded citizens of superpowers both old and new will all be clamoring for the same goods. Like investing wisely in commodities, such as cocoa and sugar, it takes a well-educated investor to understand where to put their money, especially if there are looking to take care of future generations. With the right guidance, you can choose an excellent fancy color diamond with investment qualities that will reap amazing rewards in the future.

What’s your opinion on the value increases/decreases on those commodities in 2015? Are you surprised that fancy color diamonds were in second place, following cocoa, for greatest increase of the year? Tell us your opinion in the comments!

Related Posts

- How Did 19 Commodities Stack Up To Fancy Color Diamonds Over The Last 6 Years?

- Pink Diamonds Performing Better than Gold in Recent History

- Do Collectible Cars Withstand Wealth Concentration Conditions and Requirements?

- Phillips Auction House Will Offer Unique Fancy Color Diamonds In Upcoming Hong Kong Auction

- Moussaieff Blue Diamond Leads Christie’s Hong Kong Sale

Leave a Reply

You must be logged in to post a comment.